Access to finance is one of the main challenges for small and medium-sized enterprises in Spain, especially those committed to innovation, digitalisation and sustainable growth. In this context, the Official Credit Institute (ICO) has launched ICO Growth , a new financial tool that represents a significant change in the way SMEs can obtain economic support. It is the First line of fully digital direct financing that the ICO launches, with the aim of supporting those companies with the greatest potential to grow and generate employment in the country.

ICO Growth It is a new form of public financing designed for Spanish SMEs. Most importantly, it's all about money that comes directly from the ICO , without going through banks, and which is managed in a 100% digital .

It is designed for companies that:

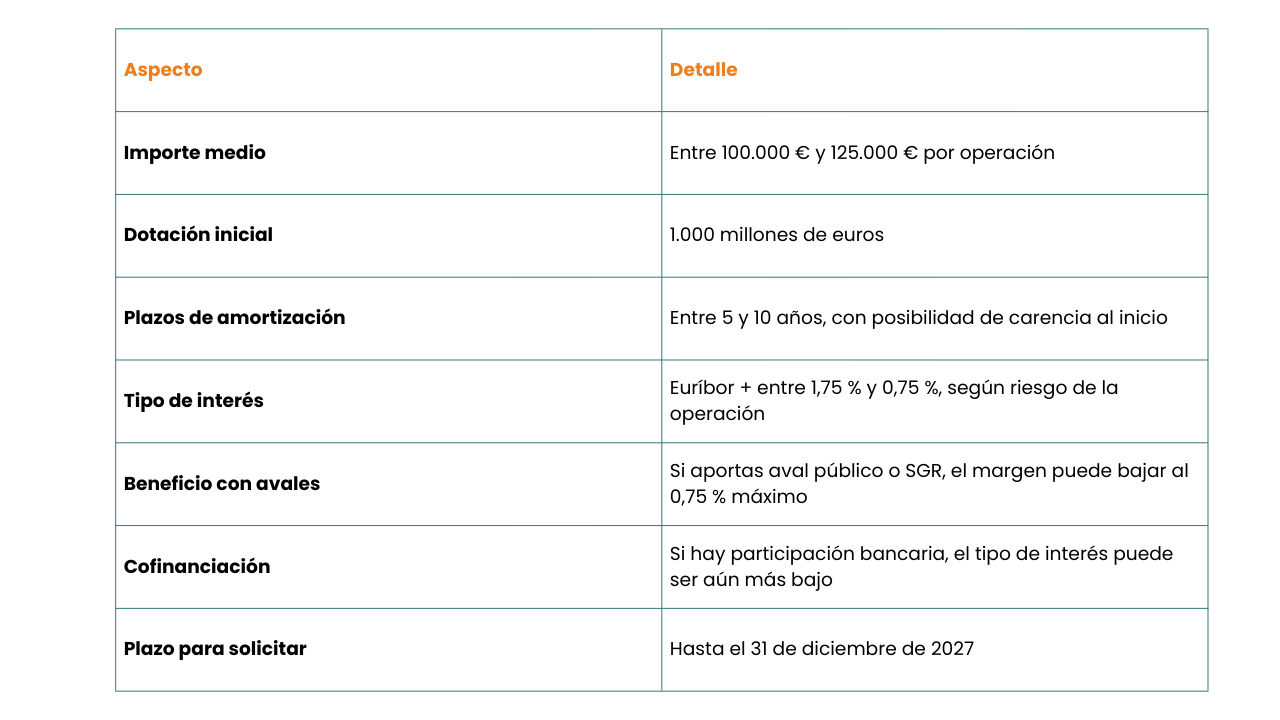

These companies can apply for financing if they need money to Invest in new projects, expand, hire more staff or innovate . The tool has a Initial allocation of 1,000 million euros and will be open until December 31, 2027 . Unlike other lines, the process is completely online, which facilitates access and reduces processing times.

The launch of ICO Growth is an important step towards modernising access to public financing. Many innovative SMEs are unable to obtain bank credit due to a lack of tangible assets or a traditional financial history. This line offers them a Viable, agile and growth-focused alternative , with conditions adapted to their reality.

In addition, the tool is aligned with the objectives of digitalisation and transformation of the Spanish business fabric, by encouraging investment in projects with a positive economic and social impact.

One of the main advantages of ICO Growth is that it offers Competitive conditions adapted to the profile of SMEs . The amount that can be requested will depend on the needs and characteristics of the project, but in general it is estimated that the operations will be between 100,000 and 125,000 euros .

The Term to repay the loan can range from 5 and 10 years old , with the possibility of having a grace period, i.e. a time in which the company will only pay interest and will not repay capital. This allows the business to have room to start generating revenue before making full loan payments.

As for the Interest rate , is linked to the Euribor, which is the benchmark index in Europe, to which is added a margin that will depend on the risk presented by the operation. That margin can be between 1.75% and 0.75% , the latter being the most advantageous option, which is obtained if the company presents a public guarantee or a Reciprocal Guarantee Society (SGR).

In addition, if this financing is combined with the participation of a bank, the interest rate can be reduced even further. This possibility of Cofinancing It's an added advantage for solid projects that require a higher investment.

Another key aspect is that this line will be available until December 31, 2027 , which gives ample scope to prepare projects, analyse financial needs and present themselves at the right time.

You can request it here .

ICO Growth It stands out for its Accessibility and flexibility . Unlike other lines of credit, it does not require the usual collateral that many banks impose. Instead, it assesses the project's potential, financial viability, and the impact it may have on the economy and employment.

In addition, the fact that it is a process Fully digital It speeds up the procedures. It is not necessary to travel or go to financial institutions. The ICO platform is connected to public bodies such as the Tax Agency or Social Security, which allows data to be verified automatically and documentation to be simplified.

Another point in favor is the Technical support . Although it is an online platform, the ICO has deployed a network of advisors throughout the country to help companies in the preparation of their applications. This provides security and support to those SMEs that do not have experience in managing public funding.

ICO Growth It is presented as an innovative and effective solution to solve one of the main barriers of the Spanish business fabric: access to financing. Its direct, digital approach aimed at companies with potential transforms the relationship between SMEs and public financing, eliminating intermediaries and simplifying procedures.

Thanks to its competitive conditions, its flexibility and the technical support of the ICO, this tool represents a real opportunity for many SMEs to take the leap they need: to invest, innovate and grow with greater security. In a context where digitalisation and economic transformation are key, initiatives such as this reinforce the strategic role of ICO as a driver of business development and a generator of employment.

For SMEs looking to move forward, ICO Growth is not just an option: it is an open door to the future .